Content Type – What Is Your Mix Of Content?

At Altitude, we’ve reviewed over 1,200 pieces of marketing content created by 12 cybersecurity leaders. Where possible, we’ve categorized each piece of content, based on its age, readability, and type.

In two previous articles we provided you with insights on content age and content readability.

Content age: In a constantly evolving industry like cybersecurity, content can quickly become out-of-date, as solutions improve and new challenges arise.

Content readability: Cybersecurity is complex enough. Content that is hard to read will either be quickly ignored, or fail to convey key messaging.

In this article, we consider the importance of having the right mix of content type for each cybersecurity solution you are marketing.

The Buyer’s Journey: Content Type Value by Journey Stage

With multiple stakeholders typically involved in the B2B buying process, having easily shareable content at each of these stages is highly valuable. Different content types have been found to be better suited for the early (awareness), middle (consideration) and late (decision) stages of the buying journey.

In the 2023 Content Preferences Survey Report from DemandGen, the most valuable content at each buying stage includes: ·

Early Stage: Webinars, research reports, blog posts, whitepapers, e-books and infographics

Middle Stage: Case studies, analyst reports, webinars and rich content media like video

Late Stage: Demos, user reviews, ROI calculators and caste studies

What We Found

We chose the following13 leaders in the cybersecurity space:

AT&T Cybersecurity

Akamai Technologies

Broadcom Inc.

Check Point

CrowdStrike

DXC Technology

F5 Networks

IBM

Palo Alto Networks

Secureworks

Sentinel One

Trend Micro

Zscaler

Then we reviewed their cybersecurity-focused product and solution webpages to discover what contents types they were leveraging in their marketing efforts.

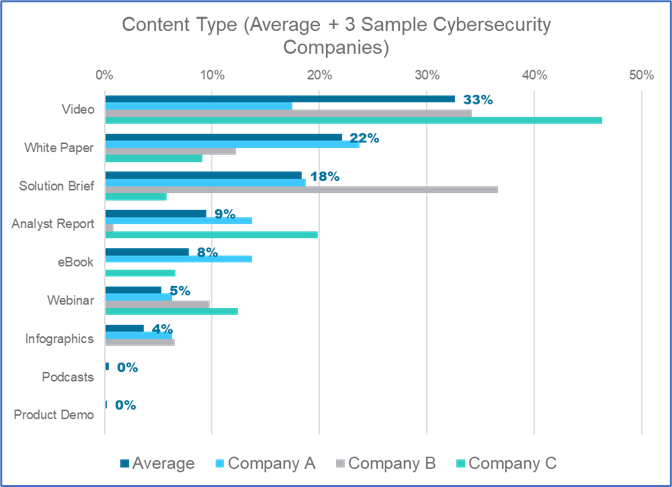

The findings below reflect the overall averages and the actual data we gathered from three of the companies reviewed.

If we take a quick look at these three sample companies, compared to the overall average of all companies reviewed:

Company A: Leans into whitepapers, analyst reports, eBooks and infographics

Company B: Skews towards a higher percentage of solution briefs and webinars

Company C: Has a higher percentage of videos, analyst reports and webinars

Without the context of knowing the individual strategies of these companies, we can only speculate as to whether they have the optimal mix, and whether these choices were deliberate. One thing we have noticed in our work with clients, is that personnel changes due to departures, re-organizations, etc. can often result in individual marketers not being aware of their full inventory of content.

If you put yourself in the position of one of these companies, it might be worth asking what potential value could:

Additional explainer videos deliver for company A, in the middle stage of the buyer’s journey?

Investment in analyst reports deliver for company B, in the early and middle stages?

A few infographics deliver for company C, in the early stages?

Your answers would surely vary but we found sharing this data with marketing leaders can generate a lively discussion and a wealth of ideas. I’d highly recommend taking the time to do a quick survey of your content and see what your mix looks like. While this data is at a company level, we also found reviewing it at an individual solution or portfolio level also generates some interesting insights. Often, it becomes clear that some valuable product or solution has been underserved from a marketing perspective.

If you’d like to learn more about the findings of our research, please reach out to Jennifer Throop.

At Altitude, we’re focused on creating content that delivers the ‘most relevant information’, in the shortest amount of time.